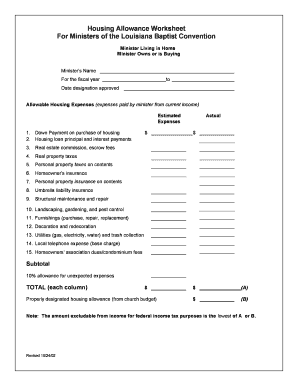

Clergy Housing Allowance Worksheet 2010-2024 free printable template

Get, Create, Make and Sign

Editing housing allowance worksheet online

How to fill out housing allowance worksheet form

How to fill out housing allowance worksheet:

Who needs housing allowance worksheet:

Video instructions and help with filling out and completing housing allowance worksheet

Instructions and Help about clergy housing allowance worksheet 2021 form

I've made this little video tour, so you can see and hear how these worksheets work and how this FHA financing works and this scenario to keep your cash down I am suggesting that you negotiate with the seller eBay 10500 toward closing the purchase detail would be a sales price of 235 three and a half percent down your loan would be to 26 but if actually has an upfront premium MIP mortgage insurance premium equal to 175 Orson alone, so we roll that into the loan you can pay in cash, but we're going to roll it into the loan, so our loan will actually be two 3744 the monthly payment is based on the rate of three and a quarter it's a 360 month or 30-year loan we're guessing the taxes of 6000 we're guessing that you'll find insurance for about 900 and then there's mortgage insurance so the payment the principal and interest you want to repay loan is one thousand four dollars plus your pay one twelfth of the tax 112 of the insurance and the monthly mortgage insurance, so you have a total payment of 17 42 and 65 cents cash to close the cash to close is almost 19000 which are down payment plus your closing costs which are itemized below plus the prepaid expenses again itemized below totaling 18800 or nearly that but because the seller is going to be asked to pay 10500 which you'll negotiate you would need 8279 and if you give a thousand dollar deposit you paid for a home inspection pay for an appraisal the total that you would need at closing is 67 79, so you really owe the full amount of 80 to 100, but you give a deposit we pay for your home inspect your paper appraisal the balances do it closing now see how I said up here to the itemization would be below this is everything now we're just going to look at the station the closing costs are itemized nest section appraisal credit report transfer tax lender's title insurance origination fee flood cert owners title recording attorney home inspection so all that came up to here prepaid expenses are basically taxes insurance and interest, so we guess that we need about seven months taxes upfront to establish our escrow account and to reimburse the seller for any taxes you may have paid in advance this is not a loan estimate, so we don't want to confuse this is just strictly for informational purposes hope you find this information helpful

Fill housing allowance worksheet 2021 : Try Risk Free

People Also Ask about housing allowance worksheet

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your housing allowance worksheet form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.